- Money by Zikoko

- Posts

- Naira Life Vol 163

Naira Life Vol 163

Also: Zikoko Money has a new Instagram!

Volume 163

Good Morning,🌞

I’ll start this with some news the team has been dying to share with you: we have a new home. Zikoko Money now has an Instagram account!

We tell these stories about money [and how Nigerians interact with it] to arm you with enough information and tools to make confident financial decisions.

I’m certain that will never change.

Now this new space will let us explore new formats, ideas and initiatives, with you at the centre of it all. So, think of us as the friend who helps you make the most out of your money. A hub for:

Real-life money stories and honest conversations. Strategies backed by data and expert insights. The essential tools you need to build and manage wealth and more.

Welcome to our new home. Follow @ZikokoMoney on Instagram and settle in. Bring a friend along too.

In this letter:

#NairaLife: He Mismanaged a Windfall in His Teens. Now, He’s Chasing Stability

Between 2019 and 2021, this 25-year-old made the most money he’s ever made in his life. However, a combination of poor financial decisions and limited exposure led to him mismanaging that windfall.

Does he regret it? Not exactly. Instead, he’s focused on surviving with what he earns and finding stable income opportunities.

Read his #NairaLife

Sign up with the code OSIMHEN, and Roqqu will cover 50% of your transaction fees when you buy, sell, or swap on the app for the next 1 month!

Start here!

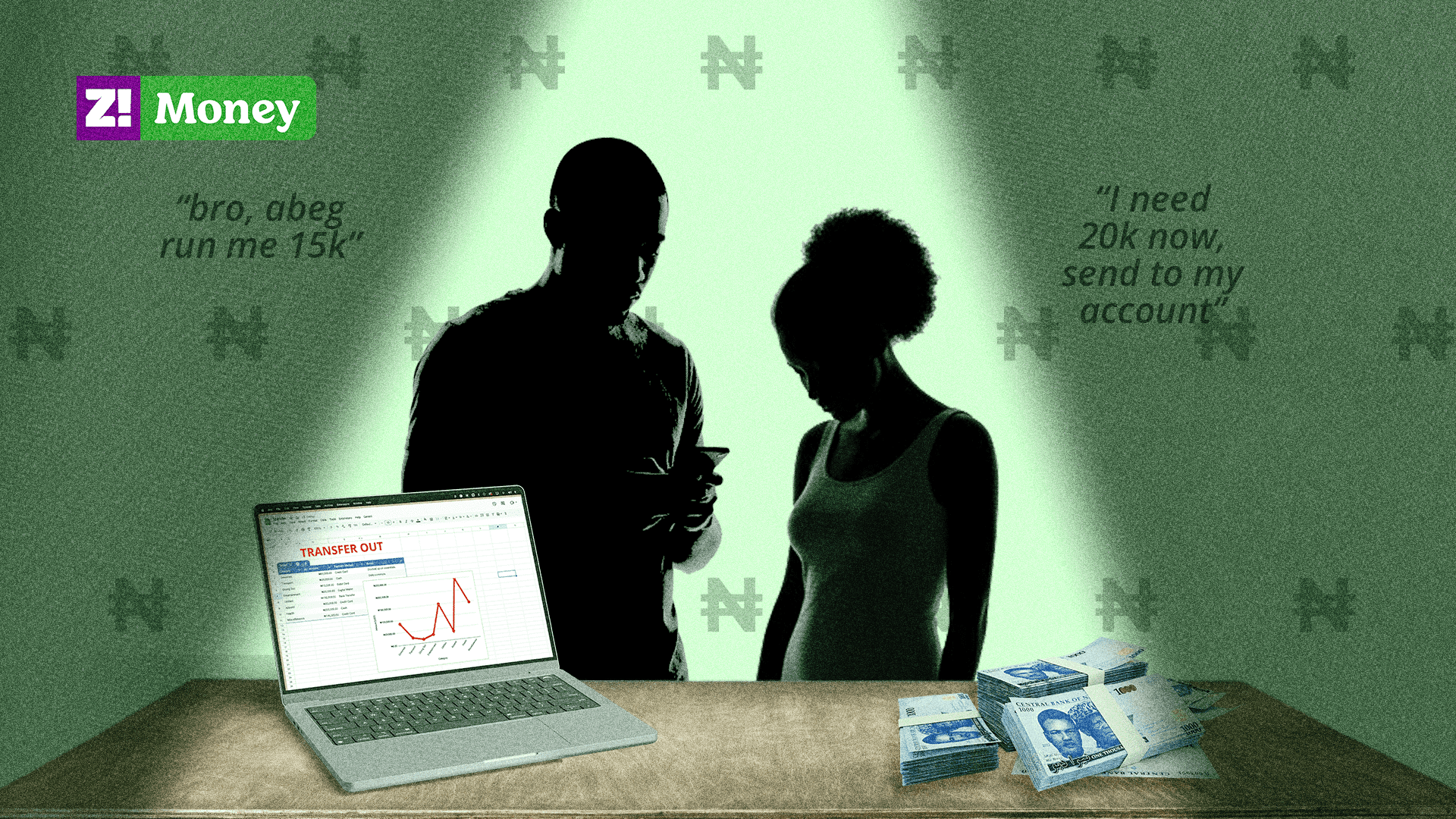

“Everyone Thinks I Owe Them Something”: The Economics of Nigerian Entitlement

“I'm often overwhelmed with responsibilities and feel like my family is too demanding, but there’s no one else who’ll come to their rescue if I don’t.”

We spoke to Nigerians whose stories reveal the economic and emotional weight of entitlement, showing how expected generosity has become both a cultural badge of honour and a silent burden. Read the full story here

Moniepoint’s 2025 informal economy report contains data from over 5 million businesses. These businesses make up over 90% of MSMEs in Nigeria. Learn more about their profits and relationship with savings, taxation and more.

Click here

I Make Money From Fishing. But Never Enough to Save

In 2013, Yiteovie (29) left school with no money, no plan, and a baby on the way. Today, fishing in a river in Down Yenagoa is her lifeline, and her biggest uncertainty.

How does she make a life from something she can’t always control?

Read here

Ask Aunty M with Reni

I have this job of six months and I earn ₦275k. The challenge is that I am struggling to save because transportation takes ₦90k. I don't pay rent — however skincare and haircare are distractions. Also, I'm planning to get certifications to improve my income but don't know how to save up for it. I have a digital marketing skill, but shockingly I don't know how to market my skills so it can be my alternative source of income. - Malu, 26

Hi Malu, thanks for writing in. First off, you’re doing well. You’ve only been in this job for six months and you’re already thinking about saving, certifications, and extra income. That shows a lot of initiative and I think you should give yourself credit for that.

Now let’s tackle your situation piece by piece:

First, you’re spending ₦90k on transportation. This is a big chunk of your income. Ask yourself: is there any way to optimise? Could you carpool, use a different route, or negotiate partial remote work days? Even shaving off ₦10–₦20k here would free up money for savings.

Next, skincare & haircare. While these are valid expenses, the key is separating needs from wants. Consider setting a fixed “beauty budget” (e.g., ₦20k/month). That way you still enjoy it, but it doesn’t eat into your financial goals.

You also mentioned wanting to save up for certifications. Instead of trying to save up in one go, create a “certification sinking fund.” For example, if your course is ₦150k and you want to pay in six months, save ₦25k/month. Treat it like a bill. This allows you to always have money for the certifications when they arise. Automate this and keep it in a separate account so you don’t spend it.

Lastly, the fact that you have a digital marketing skill already sets you apart from most. It’s very normal to have skills but not know how to market them. In order to get clients you can approach it in a free ways. You could offer free value of social media, showcasing your skills and educating your potential clients. This is a natural lead magnet. You should also consider having a place where you showcase your portfolio of work, even unpaid projects. Do this on IG, LinkedIn or on a website or portfolio site. Also, join freelance platforms like Fiverr or Upwork to get connected to clients.

I'm rooting for you.

![]()

Xoxo, Reni

Where The Money At?!

We can't say we're about the money and not actually help you find the money.

So we've compiled a list of job opportunities for you. Make sure you share this with anyone who might need it because in this community, we look out for each other.

Again, don’t mention. We gatchu.

All good things must come to an end. But not this good thing. We’ll be back next week.

In the meantime, keep reading Zikoko’s articles and be sure to share the love.

See you next week...

Yours cashly,

Toheeb,

Zikoko's 'OG' Mr. Money

Did someone awesome send this to you?

Subscribe to this Newsletter