- Money by Zikoko

- Posts

- Naira Life Vol 155

Naira Life Vol 155

This is how Aunt M breaks it down.

Volume 155

In partnership with

Good morning 🌞

On August 8, 2025, we pulled off the first-ever Naira Life Conference. The goal? To take the curiosity and care that powers Naira Life and bring it to a live audience. A room where industry leaders, finance experts, creators, entrepreneurs, and everyone figuring out money could have honest, useful conversations about wealth and money management.

And we did it. Over 900 people showed up.

You were among the first to know when we announced the event. Now here’s the next bit of good news: we’ve started rolling out sessions from the Naira Life Conference on YouTube.

Why? Many of you told us you couldn’t make it — Friday events can be tricky (we get it, sorry 😅). So think of this as our way of bringing the experience to you. You can start watching the sessions here.

Oh, and one more thing: the Naira Life Conference is coming back next year. We’ve started shaping the experience and can’t wait to share it with you.

Speaking of events, here’s a little plug: did you know Zikoko also covers events and brand activations? We bring your brand moments to life with our signature storytelling voice and cultural credibility, capturing the vibe, amplifying your story, and connecting it with the audience that cares.

Want to work with us? Fill out this form to explore Zikoko’s event coverage or other advertorial options.

In this letter:

#NairaLife: This 28-Year-Old Earns ₦9m/Month but Doesn’t Feel Financially Secure

In less than three years, this 28-year-old’s earning power has increased from ₦125k to over ₦9m/month.

However, she struggles with financial management and hasn’t built systems to protect her money. She hopes that changes soon.

This is her #NairaLife

Join hundreds of winners for a chance to win millions of Naira in prizes in our ReferIN and Win Promo, running until Nov 1, 2025. Refer 2+ people to sign up on InvestNaija using your referral code for a chance to qualify for the draw

Join now!

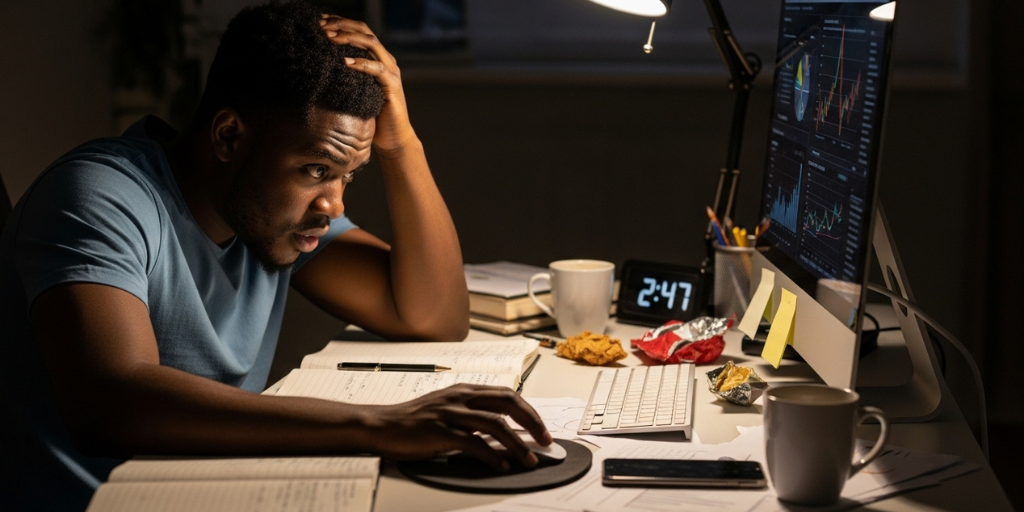

I Got Addicted to Crypto, and It Was a Disaster

Stephen’s* first brush with crypto in 2016 felt like a ticket to lasting wealth. By 2021, he was all in. But when the market crashed, it took everything with it.

In this story, he talks about how his decisions wrecked his finances, strained his relationships and forced him to rebuild from almost zero. Read the full story here

Pay for tools, ads, subscriptions, and more with secure USD virtual cards built for global spending. From Amazon to Canva, Netflix to Meta, Vban makes it all seamless and reliable. No payment limits. No FX rip-off. Create your Vban virtual card today.

Download VBan!

I Bet on My Fashion Brand After Uni. Now I Earn Over ₦1 Million a Month

At 24, Jemima makes over ₦1 million a month from her fashion design business.

What started as a final-year project in fashion school has grown into a thriving bridal brand. Here’s how she did it.

Ask Aunty M with Reni

I’m a medical student who’s trying to increase my income. Medical school isn't cheap, and the price of dollars keeps making things worse. I have about $500 saved across apps, but the US stocks have been plummeting, making me lose about half of this money. Should I remove the money or just let it be? Also, how can I diversify my portfolio? Thank you.- Kola, 22

Hi Kola, thanks for writing in. I want first to acknowledge how frustrating this must be — the market volatility makes a big difference in returns. You aren’t alone; this is a very common struggle.

Should you remove your money? I think it depends on your goals. If you have a short-term goal (less than two years), then I wouldn’t recommend investing this money. Investing is for the long term because volatility is inevitable. Instead, save the money in a high-interest savings account or some kind of fixed-income instrument where returns are guaranteed.

If you have a longer-term goal and don’t need the funds immediately, this is where stock investing comes in. Market dips are temporary, and historically, US stocks always recover over time. However, you may want to revisit your investment strategy. It seems to me as though you are not confident in your investing abilities yet, and you’ve jumped from zero knowledge to investing in individual stocks, which require a more advanced strategy. I’d suggest investing in Exchange-Traded Funds — they contain a portfolio of individual stocks, are created by a fund manager, and therefore offer a safer bet with less volatility.

You also asked about diversifying your portfolio. These ETFs can offer diversification because they consist of different types of companies across various sizes and industries.

I hope this helps, and I'm rooting for you.

![]()

Xoxo, Reni

Where The Money At?!

We can't say we're about the money and not actually help you find the money.

So we've compiled a list of job opportunities for you. Make sure you share this with anyone who might need it because in this community, we look out for each other.

Again, don’t mention. We gatchu.

All good things must come to an end. But not this good thing. We’ll be back next week.

In the meantime, keep reading Zikoko’s articles and be sure to share the love.

See you next week...

Yours cashly,

Toheeb,

Zikoko's 'OG' Mr. Money

Did someone awesome send this to you?

Subscribe to this Newsletter