- Money by Zikoko

- Posts

- Naira Life Vol 131

Naira Life Vol 131

Also: He’s a saver. she’s not. Now it’s a problem.

Volume 131

Good morning ☀️

This week’s stories are for the tired hustlers, the silent savers, and everyone who’s ever thought, “Maybe money isn’t the problem, maybe I am.”

As usual, we’re opening with NairaLife, and it’s one of those “how are you doing all this and still broke?” stories. Yet it’s real, and painfully familiar.

This week’s Love Currency is about a couple with wildly different money habits. One’s a disciplined saver, the other just wants to enjoy life a little. The tension is palpable. And it’s got one half of the couple asking: Is this really going to work?

There’s also the hard lesson of what happens when you make a big financial leap and life pulls the rug out. In this context, it’s a ₦2.7m loan, a job loss, and a debt story that’ll make you grab your calculator.

Let's get into it.

In this letter:

- Naira Life: He Has Multiple Side Hustles, but He Just Wants a Stable Cash Flow

- Love Currency: This Writer’s Frugal Lifestyle Is Causing Friction in His Relationship

- I Took a ₦2.7m Loan to Buy a Car. Then I Lost My Job

- Ask Aunty M: I Save 80% to My Salary but I Struggle for the Rest of the Month

- Where The Money At?!

#NairaLife: He Has Multiple Side Hustles, but He Just Wants a Stable Cash Flow

From photography to cleaning and CCTV installation, this #NairaLife subject has done it all. However, bad financial decisions have marred his various money-making ventures.

He’s recognised the pattern and is now ready to fix it. But first, he needs to find a stable income.

This is his #NairaLife

Get rewarded in real Gold + free insurance! With the Altbank app, every transfer you make earns you free grams of real Gold. Plus, open an account and get free takaful insurance for your car, gadgets, and mobile.

Click here to get started!

Love Currency: This Writer’s Frugal Lifestyle Is Causing Friction in His Relationship

Etim* (29) and Mandy* (25) have been dating since 2022.

For #LoveCurrency, Etim talks about the differences in their financial habits, acknowledging that he’s the saver in the relationship, and the one reason he might end their union. Read the full story here

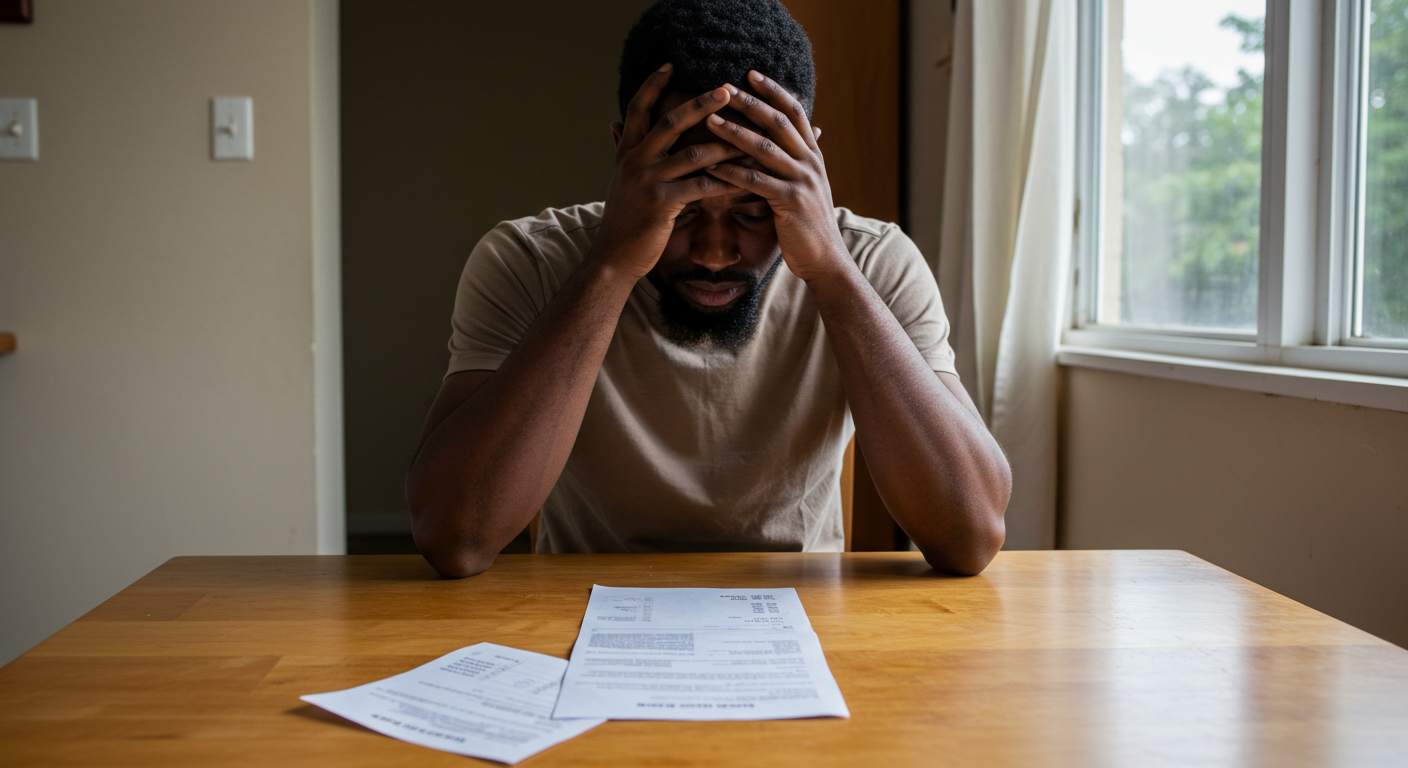

I Took a ₦2.7m Loan to Buy a Car. Then I Lost My Job

This 34-year-old spent his life savings, plus a ₦2.7m loan, on a car that was supposed to make his life easier. .

Instead, it plunged him into debt after an unexpected job loss. It took him 15 months, but he managed to pay off his debt. Here's how he did it

Ask Aunty M with Reni

I earn ₦150k/month and put aside ₦120k monthly to rent a place because I set a deadline for myself. I live with my mum, and it's becoming insufferable. Then I live on ₦30k. But I have to borrow money at the end of the month. Any advice, please? - Cassandra, 28

Hi Cassandra. You borrow money each month because your savings rate is too high compared to your income. You are saving 80% of your income, but that isn't realistic based on your expenses. ₦30k is nearly impossible to live on unless someone is covering some of your expenses. You need to figure out how much you spend every month. To do so, start tracking your expenses. Write down everything that you spend money on each month. Once you do that – let's say you figure out that you usually spend ₦60k monthly – have two options.

The first option is to reduce your savings to ₦90k per month so you don't have to go into debt. This will mean moving out will take you longer, but you won't be in debt. If you are steadfast in your decision to move out by your deadline, you need to increase your income. Using the ₦60k example again, look for jobs or a second source of income that can account for the ₦60k you need to live on monthly plus your ₦120k savings, meaning you need to make at least 180k monthly. This will allow you to cover your monthly expenses and save without debt.

Lastly, remember that once you move out, you will incur many more expenses than when you lived at home. I'm not trying to tell you to stay home, but be realistic about how much you will have to spend once you move out, as now all food costs, rent, home maintenance, and more will be on you. I don't want you to move out and now get into more debt trying to maintain the new home.

Try to increase your income before moving out, and ensure the place you move into is within your means, even if it means getting roommates to lower the costs.

I'm rooting for you and hope it works out.

![]()

Xoxo, Reni

Where The Money At?!

We can't say we're about the money and not actually help you find the money.

So we've compiled a list of job opportunities for you. Make sure you share this with anyone who might need it because in this community, we look out for each other.

Again, don’t mention. We gatchu.

All good things must come to an end. But not this good thing. We’ll be back next week.

In the meantime, keep reading Zikoko’s articles and be sure to share the love.

See you next week...

Yours cashly,

Toheeb,

Zikoko's "OG" Mr. Money

Did someone awesome send this to you?

Subscribe to this Newsletter